Considering financing for your project

When deciding to build your house, you need to ensure that you have the finances in order to have a successful project. The only way to make sure of it is to have an extensive and comprehensible budget. When creating a budget for your build it is important not to miss anything because the smallest of details can turn into costly surprises. It is best to find a trusted, reputable builder you feel comfortable with. They can help you understand all the costs associated with it. This is a very important step to ensure that you are not hung dry half way through your build.

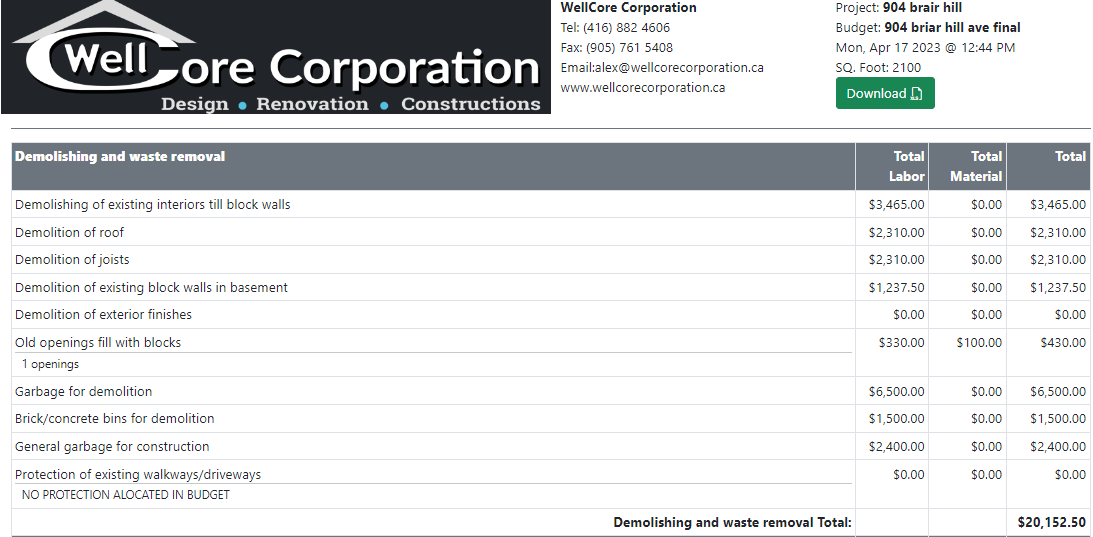

Keep in mind when creating the budget it is always better to have a true and realistic budget and listen to the advice of your builder when creating it with them. The most important consideration to be made when creating a budget is for it to be detail focused, transparent, accurate to the current market, and fully comprehensible without hidden fees. Keep in mind sometimes there may be some compromises that will have to be made during the build to stay on budget. Be mindful that it is best practice to have a contingency reserve in case some unexpected surprises arise (structural, shoring, water proofing, reinforcement of existing walls as well as certain surprises that cannot be predicted before the demolition starts). It is important to understand that as long as you remain flexible during the build, there will always be alternative options you are able to pick and choose from, if the original plan sends you over budget.

Now that your budget is built, time to consider your financial options.

There are two ways that people go about it. First being a mortgage from the bank or construction loan. Second being private financing or loan. Private financing is more expensive than the banks, however depending on the circumstance it may not be plausible. In both cases it is important to have the numbers ready to go beforehand.

You may wonder why is it important to have a selected builder at this stage? The banks look favourably at the applications when they recognise the builder. The reason the bank tends to look favourably includes a lot of reasons. Some of these reasons include their licences, their insurances, and their past experience. The more seasoned the builder, the more favourable they look at it. Thus the budget that the builder provides you with will be needed for the applications, as well as the builder can assist you with any additional paperwork or forms that can boost your application above others. Having all the correct paperwork from the start can speed up and ease the approval process.

When looking at private loans, a potential benefit of a seasoned builder is that they are able to offer you their expertise and potentially suggest some private lenders they've worked with in the past. They can guide you in the options you were provide to help make the correct decision based on your specific circumstance